5 Tips about Fredericksburg bankruptcy attorney You Can Use Today

You will have a far better probability of affording your expenses over the calendar year should you were to receive more money Every single paycheck.

It’s recommended to refer to with a bankruptcy attorney to grasp the details of how a Chapter 7 filing will impact an IRS garnishment in the specific scenario.

Debtors with a daily profits can use Chapter 13 bankruptcy to cope with their overpowering debts, but you can find lengthy-term repercussions for customers to choose this route.

Normally, your tax refund can be thought of part of your respective bankruptcy estate, perhaps accustomed to repay creditors. This prospect can be concerning, as tax refunds typically represent a significant sum that many rely upon for financial relief or important buys.

Stick to the repayment strategy around 3 to five years. Your trustee will gather and distribute payments during this time. When you’re carried out with repayment, the bankruptcy scenario will be discharged.

What Solutions Does Lawinfopedia Present? Lawinfopedia is dedicated to encouraging Those people needing absolutely free or low-Charge legal companies. We largely Acquire two varieties of data to help our buyers resolve their lawful challenges.

Our Internet site undergoes standard updates and maintenance, which means there may be moments when we are unable to make sure Fredericksburg bankruptcy attorney that all details is totally precise and latest. We are devoted to constantly incorporating new businesses and attorneys to our listings and updating our articles with the newest information mainly because it will become available.

Folks have to clearly show they have the implies for making regular payments. They need to disclose their resources of money and submit the data for the court inside of fourteen times of filing a petition.

Whilst bankruptcy will remain on your credit score report for approximately 7 see this here a long time, you'll find various factors you might want to decide on Chapter thirteen about other choices.

Not all tax debts may be discharged in bankruptcy. Typically, only certain profits tax debts are dischargeable. This typically consists of federal earnings tax debts that fulfill particular requirements, like becoming at the least three years outdated and dependant on a tax return that was filed promptly and without fraud.

The impact of bankruptcy on the tax try this site return is usually shaped by the sort of bankruptcy chapter submitted. Chapter seven bankruptcy, also referred to as "liquidation bankruptcy," and Chapter thirteen bankruptcy, typically called "reorganization bankruptcy," handle tax debts in another way.

I'd personally suggest filing bankruptcy Once you have gained and expended try these out your refund on ordinary home costs to stop any difficulties.

Professional idea: Professionals are more likely to solution issues when history and context is presented. The more specifics you give, important source the more quickly and a lot more comprehensive reply you are going to get.

While this isn’t technically trying to keep The cash in the pocket, it's transferring the amount into something you are able to maintain, something that is not likely to become eligible for seizure for the duration of your bankruptcy.

Jaleel White Then & Now!

Jaleel White Then & Now! Tia Carrere Then & Now!

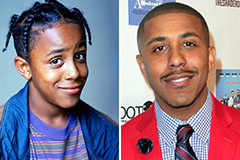

Tia Carrere Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!